[ad_1]

Amazon has launched a new bid into luxury with the rollout of a couture shopping experience that will feature established and emerging fashion houses and brands.

The company’s Luxury Stores launched on Amazon’s mobile app Tuesday with the iconic fashion house, Oscar de la Renta. The designer’s store features its pre-Fall and Fall/Winter 2020 collections of ready-to-wear apparel, handbags, jewelry, accessories, and a new perfume. More brands will launch within Amazon’s Luxury Stores in the coming weeks and seasons, the company said in a statement.

“I would guess that somewhere near 100 percent of our existing customers are on Amazon and a huge percentage of those are Prime members,” Alex Bolen, CEO of Oscar de la Renta, told Vogue. “For me to get more mindshare with existing customers in addition to getting new customers — that’s the name of the game.”

The new store concept is only open to invited Prime shoppers in the U.S., and allows customers to see items in 360-degree detail. Luxury brands will have more independence over how they stock their stores and their pricing through Amazon’s merchandising tools, which allow them to create and personalize the content of their store. They will also be able to offer their own customer services to shoppers to answer specific questions about their collection and choose how they pack and ship to their customers, the company said.

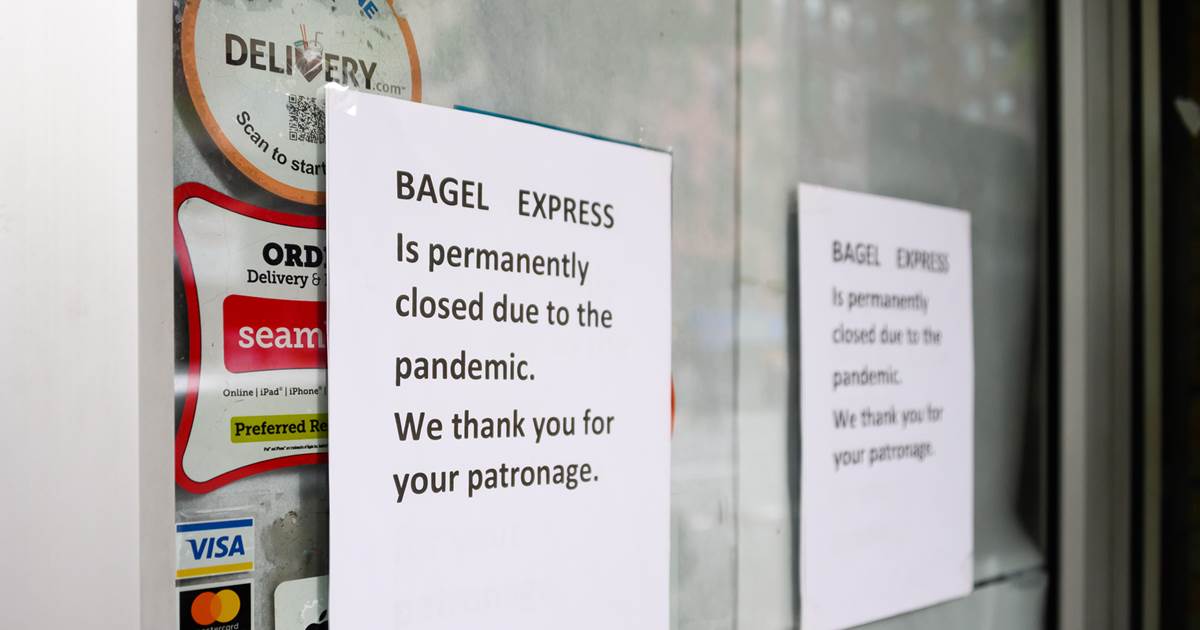

Amazon’s Luxury Stores come at a tumultuous time for luxury retail as the pandemic keeps high-end brick-and-mortar stores closed and department stores such as Lord & Taylor, Neiman Marcus, and discount retailer Century 21 file for bankruptcy. French luxury goods conglomerate Kering and fashion powerhouse LVMH Moët Hennessy Louis Vuitton reported a respective 29 and 28 percent drop in revenue during the first half of 2020 compared to the same time last year as a result of the coronavirus outbreak.

“The impact of the epidemic on revenue and annual results cannot be precisely assessed at this stage without knowing the timetable for the return to normal business in the different areas where the group operates,” LVMH told investors in August. “After a second quarter severely affected by the crisis, we can hope that the recovery will materialize gradually in the second half.”

Slowing economic activity due to the pandemic could have a particularly harsh impact on the luxury retail industry, which relies on in-store personal service and the tactile experience of shopping for high-end pieces, according to an April report from McKinsey & Company. The financial advisory firm estimated that about 80 percent of publicly listed fashion companies in Europe and North America would be in financial distress if they continued to stay closed for another two months. The firm also estimates “a large number” of global fashion companies will go bankrupt in the next 12 to 18 months.

About 80 percent of publicly listed fashion companies in Europe and North America could be in financial distress if they continue to stay closed for two more months.

But Amazon’s most recent dive into drawing luxury shoppers to buy couture on its marketplace may offer a lifeline to luxury companies who have struggled to expand their e-commerce business, said Alexis DeSalva, a senior research analyst of retail and e-commerce with the market services company Mintel.

“Before the pandemic there was definitely an interest in luxury,” she said. “You have to take a step back because the way consumers are shopping is different. Barneys, Neiman Marcus, Century 21 — a lot of luxury or traditional brick-and-mortar businesses haven’t made it easy for a luxury shopper, or someone who might want to buy luxury for the first time, to shop online.”

For Oscar de la Renta, the opportunity to hand off the fulfillment and delivery arm of their online business is a major draw for the fashion house. “The return rate in our brick-and-mortar stores is low single digits on a bad day and almost 30 percent for online sales,” Bolen told Vogue.

“It means I need to have much more inventory, many more people dealing with returns,” he said. “It’s kind of a different business than what we’re used to. We have to learn on the fit side how we can get better, and Amazon is very interested in that problem. They’ve got teams of people that are thinking about this all day long.”

Amazon previously scrapped early breaks into luxury fashion including MyHabitSite, a Gilt Groupe competitor featuring flash sales on luxury items, while others such as StyleSnap launched with a sputter among shoppers. For years, Amazon’s reputation has been tied to the marketplace’s struggle to fight fake luxury goods sold by third-party sellers leading some companies such as Nike to refuse to sell on the site. Even with the support of Vogue editor-in-chief Anna Wintour and growing apparel sales on its marketplace, Amazon CEO Jeff Bezos has struggled to break the company into high-end fashion.

Jean Jacques Guiony, LVMH’s chief financial officer, told investors during an earnings call in 2016 that the company believes “the business of Amazon does not fit with LVMH, full stop, and it does not fit with our brands.”

But Sarah Willersdorf, global head of luxury with Boston Consulting Group, said the pandemic has changed how luxury retailers are thinking about their survival.

“This is the moment where we’re encouraging all brands in retail to test and experiment as much as they can,” she said. “Those that can maintain some headspace and investment to experiment are seeing interesting results and that’s a big difference in luxury. That ability to test and learn and use data I think is really positive.”

Doug Walsh, a novelist based in Snoqualmie, Washington, told NBC News that he was surprised he received an invitation to Amazon’s new luxury experiment. He and his wife are avid hikers and travelers who don’t spend more than $30 on a shirt, he said. They are frequent Prime shoppers, but not luxury.

“The items look great and I think it’s neat they’re expanding,” he said. “I would buy maybe a watch or something else that was more of an appeal that fit our lifestyle — but if it ends up being just high-end luxury designers then we’re not the right people for that.”

[ad_2]

Source link